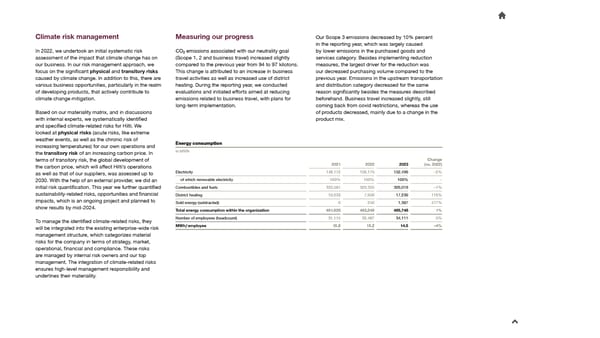

Climate risk management Measuring our progress Our Scope 3 emissions decreased by 10% percent in the reporting year, which was largely caused In 2022, we undertook an initial systematic risk CO emissions associated with our neutrality goal by lower emissions in the purchased goods and 22 services category. Besides implementing reduction assessment of the impact that climate change has on (Scope 1, 2 and business travel) increased slightly our business. In our risk management approach, we compared to the previous year from 94 to 97 kilotons. measures, the largest driver for the reduction was focus on the signi昀椀cant physical and transitory risks This change is attributed to an increase in business our decreased purchasing volume compared to the caused by climate change. In addition to this, there are travel activities as well as increased use of district previous year. Emissions in the upstream transportation various business opportunities, particularly in the realm heating. During the reporting year, we conducted and distribution category decreased for the same of developing products, that actively contribute to evaluations and initiated efforts aimed at reducing reason signi昀椀cantly besides the measures described climate change mitigation. emissions related to business travel, with plans for beforehand. Business travel increased slightly, still long-term implementation. coming back from covid restrictions, whereas the use Based on our materiality matrix, and in discussions of products decreased, mainly due to a change in the with internal experts, we systematically identi昀椀ed product mix. and speci昀椀ed climate-related risks for Hilti. We looked at physical risks (acute risks, like extreme weather events, as well as the chronic risk of EEnneerrggyy co connsusummppttiioonn increasing temperatures) for our own operations and in MWh the transitory risk of an increasing carbon price. In terms of transitory risk, the global development of Change the carbon price, which will affect Hilti’s operations 2021 2022 2023 (vs. 2022) as well as that of our suppliers, was assessed up to Electricity 148,112 156,175 152,496 –2% 2030. With the help of an external provider, we did an of which renewable electricity 100% 100% 100% – initial risk quanti昀椀cation. This year we further quanti昀椀ed Combustibles and fuels 333,581 329,355 326,019 –1% sustainability-related risks, opportunities and 昀椀nancial District heating 10,233 7,959 17,230 116% impacts, which is an ongoing project and planned to Sold energy (subtracted) 0 240 1,387 477% show results by mid-2024. Total energy consumption within the organization 491,926 493,249 495,746 1% Number of employees (headcount) 31,115 32,487 34,111 5% To manage the identi昀椀ed climate-related risks, they MWh / employee 15.8 15.2 14.5 –4% will be integrated into the existing enterprise-wide risk management structure, which categorizes material risks for the company in terms of strategy, market, operational, 昀椀nancial and compliance. These risks are managed by internal risk owners and our top management. The integration of climate-related risks ensures high-level management responsibility and underlines their materiality.

2023 Sustainability Report Page 17 Page 19

2023 Sustainability Report Page 17 Page 19